Exercise 7.3 - Chapter 7 Financial Mathematics 11th Business Maths Guide Samacheer Kalvi Solutions - SaraNextGen [2024-2025]

Updated By SaraNextGen

On April 24, 2024, 11:35 AM

Exercise 7.3

Text Book Back Questions and Answers

Choose the correct answer.

Question 1.

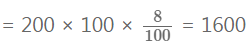

The dividend received on 200 shares of face value ₹ 100 at 8% dividend value is:

(a) 1600

(b) 1000

(c) 1500

(d) 800

Answer:

(a) 1600

Hint:

Dividend

Question 2.

What is the amount related is selling 8% stacking 200 shares of face value 100 at 50?

(a) 16,000

(b) 10,000

(c) 7,000

(d) 9,000

Answer:

(b) 10,000

Hint:

Amount = 200 × 50 = 10000

Question 3.

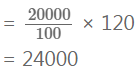

A man purchases a stock of ₹ 20,000 of face value 100 at a premium of 20%, then investment is:

(a) 20,000

(b) 25,000

(c) 22,000

(d) 30,000

Hint:

Investment = Number of shares × Market value

Question 4.

A man received a total dividend of 25,000 at a 10% dividend rate on a stock of face value 100, then the number of shares purchased.

(a) 3500

(b) 4500

(c) 2500

(d) 300

Answer:

(c) 2500

Question 5.

The brokerage paid by a person on this sale of 400 shares of face value 100 at 1% brokerage:

(a) 600

(b) 500

(c) 200

(d) 400

Answer:

(d) 400

Hint:

Brokerage

= 400

Question 6.

Market price of one share of face value 100 available at a discount of 9½ % with brokerage ½% is:

(a) 89

(b) 90

(c) 91

(d) 95

Answer:

(c) 91

Hint:

Market price = Face value – Discount + Brokerage

= 100 – 9½

= 100 – 18/2

= 100 – 9

= 91

Question 7.

A person brought a 9% stock of face value 100, for 100 shares at a discount of 10%, then the stock purchased is:

(a) 9000

(b) 6000

(c) 5000

(d) 4000

Answer:

(a) 9000

Hint:

Face value = 100

Discount = 10%

Market price of a share = 100 – 10 = 90

Number of share = 100

Stock purchased = 100 × 90 = ₹ 9000

Question 8.

The Income on 7 % stock at 80 is:

(a) 9%

(b) 8.75%

(c) 8%

(d) 7%

Answer:

(b) 8.75%

Hint:

Income = 7/80 × 100

= 0.0875 × 100

= 8.75%

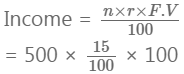

Question 9.

The annual income on 500 shares of face value 100 at 15% is:

(a) 7500

(b) 5000

(c) 8000

(d) 8500

Answer:

(a) 7500

Hint:

= 7500

Question 10.

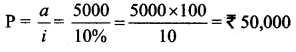

5000 is paid as perpetual annuity every year and the rate of C.I. 10%. Then the present value P of an immediate annuity is:

(a) 60,000

(b) 50,000

(c) 10,000

(d) 80,000

Answer:

(b) 50,000

Hint:

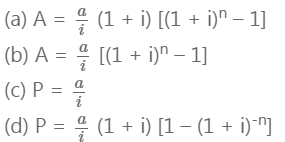

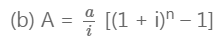

Question 11.

If ‘a’ is the annual payment, ‘n’ is the number of periods and ‘i’ is compound interest for ₹ 1 then future amount of the annuity is:

Answer:

Question 12.

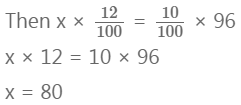

A invested some money in 10% stock at 96. If B wants to invest in an equally good 12% stock, he must purchase a stock worth of:

(a) 80

(b) 115.20

(c) 120

(d) 125.40

Answer:

(a) 80

Hint:

Let x be B stock worth.

Question 13.

An annuity in which payments are made at the beginning of each payment period is called:

(a) Annuity due

(b) An immediate annuity

(c) perpetual annuity

(d) none of these

Answer:

Annuity due

Question 14.

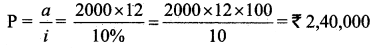

The present value of the perpetual annuity of 2000 paid monthly at 10 % compound interest is:

(a) 2,40,000

(b) 6,00,000

(c) 20,40,000

(d) 2,00,400

Answer:

(a) 2,40,000

Hint:

Question 15.

An example of a contingent annuity is:

(a) Life insurance premium

(b) An endowment fund to give scholarships to a student

(c) Personal loan from a bank

(d) All the above

Answer:

(b) An endowment fund to give scholarships to a student

Also Read : Exercise-8.2-Chapter-8-Descriptive-Statistics-and-Probability-11th-Business-Maths-Guide-Samacheer-Kalvi-Solutions